For the time being, central banks in Europe and the US appear to be succeeding in cooling the economy through a so-called “soft landing” in which the interest rate increases do not push the economy into recession. This is exceptional because monetary tightening usually results in a “hard landing”. The consensus expectation is that the world economy will achieve real growth of 3% this year and next.

In the US, GDP is growing 2.9% year over year, unemployment remains near the bottom at 3.9% and consumer spending remains flat at a small plus of 0.7%. For the Eurozone, the most recent statistics of these three measures are 0.4%, 6.4%, 0% respectively. Finally, China, which reports growth of 5.3%, unemployment of 5% and retail sales increasing by 3.7%.

The investment outlook for the previous quarter dealt extensively with inflation and this picture has not changed in the past three months. Since 2021, the investment committee has taken into account the scenario that inflation in the US and Europe will remain at a higher level than that of 2009 to 2021, and that interest rate cuts will be implemented less quickly than the path that the market is currently taking into account, i.e. a “higher-for-longer” scenario.

Bonds and liquidities

Prompted by the above interest rate view, the portfolios are characterized by relatively short term bonds. The additional return on corporate bonds (the credit spread) was at a high level at the beginning of 2024. That is why the allocation within bonds to those securities is relatively high. This worked out well. With the interest rate increase in the bond market this year, the selected bonds have relatively low price declines compared to the market average and due to the well-performing corporate bonds, the bond portfolio achieved a positive return against a decline in the broader bond market.

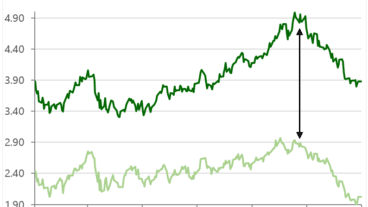

Looking ahead, the yield curve remains inverted so long bonds currently have a lower effective yield than shorter bonds. For example, the short ECB interest rate is 3.75% and the interest rate on Dutch 10-year government bonds is 2.9%. Normally, the long-term interest rate is higher than the short-term interest rate, in order to reward investors for the higher interest rate risk. We only consider long(er) bonds interesting if clients at least recoup the expected inflation and receive a reasonable premium for the interest rate risk taken. For 5-year bonds we apply a required surcharge of at least 1%, for 10-year bonds at least 1.5% and for 30-year bonds at least 2%. However, there is currently no premium available with (very) long maturities, so we remain very reluctant in adding long bonds.

Equities

In 2022, (growth) equities with a high valuation were hit hardest by the interest rate rise because they are more dependent on (uncertain) future cash flows than equities with a low valuation. The present value of future cash flows is lower when these are discounted at a higher interest rate.

The current interest rate picture has been translated into the portfolio by structurally reducing companies with relatively high valuations (based on, for example, the price/earnings ratio) in favor of shares with lower valuations. The highest valued sector is technology and this has resulted in an underweight in technology. This year, Microsoft, SAP and ASML, among others, have been reduced, all of which trade well above their average valuation. However, shares with a high price-earnings ratio have become even more expensive since then. The lower allocation to the technology sector has cost relative returns within equities. This sector achieved a return of more than 30% this year and the market average excluding technology was only 10.9%. The selected shares have achieved a strong positive return, but the market average is higher this year, mainly due to the high returns of the chip industry within technology shares.

The hegemony of technology companies has led to an unprecedented concentration of the stock market. Of the world stock index, the weighting of the top five companies represented 5% ten years ago, 10% five years ago and currently this concentration is almost 18%. So now even the broadly composed world stock index has become highly concentrated; and with this a large part of passive investments as well. One consequence, for example, is that the top five shares cannot possibly be overweight compared to the benchmark in active management when taking into account good diversification and sound risk management.

Looking ahead, we are sticking to the principles with which we have achieved excellent returns in the past and avoided major capital losses. Technology shares have a heavy weighting in the market and an average high valuation, other stocks are not expensive despite high interest rates and assuming an economic “soft landing”.

Precious metals

Laaken defines precious metals as a separate asset class and invests in gold in its portfolios. This investment category has achieved the best returns since the beginning of this year. Gold pays no dividends or interest and is therefore fundamentally difficult to appraise. After the 16% increase this year, it cannot be concluded whether the precious metal is now expensive. The gold position has increased in percentage terms due to market movements, this higher allocation is maintained as insurance against unforeseen and geopolitical risk.