World economy

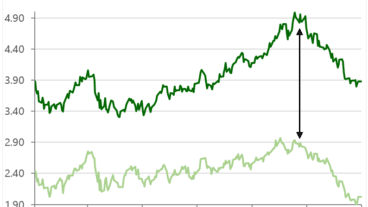

First of all energy, high energy prices are driving up costs of living and production significantly. The outlook for the energy market is uncertain, especially in Europe due to its dependence on Russia. However, the recent price increase is partly due to financial speculation and companies seeking to secure supply. This creates a lot of volatility and could turn around quickly if sentiment changes. Europe is currently preparing for a scenario in which Russia stops supplying gas.

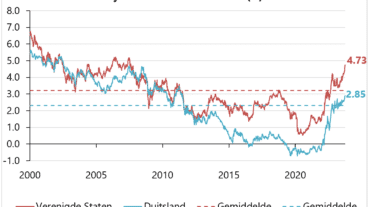

Second inflation, the most recent consumer price index for the Eurozone for June is 8.6% higher than a year ago. For the United States, the “Personal Consumption Expenditure (PCE) deflator” for May is plus 6.3%. Excluding food and energy prices, the core price increases are more moderate at 3.7% and 4.7%, respectively. It is the first time in the working lives of the three youngest working generations in the West that consumer prices have risen so rapidly. Tight labour markets allow workers to demand higher wages, which can weigh on profit margins. With the current price increases, the purchasing power of consumers is decreasing significantly. Recent wage increases are not enough to compensate for the fall in real income. Consumer confidence in Europe and the US is therefore at its lowest level in many years, but consumer spending is still rising in both regions, as savings balances are high.

Third, to curb high inflation, central banks are raising interest rates and tightening monetary policies. The ECB will soon end its negative interest rate policy and the US Federal Reserve has hiked rates that bring US interest rates back to pre-Corona levels. The weaker economic outlook is also driving up corporate bond spreads, on top of higher interest rates. Financing costs for companies, as well as mortgage costs, therefore increase significantly. The market is sceptical that central banks can slow down the economy without plunging it into a recession, or a so-called “soft landing”. Markets had anticipated many more interest rate hikes for the coming year, and interest rates have now fallen slightly again since mid-June.

In an optimistic scenario, lower economic growth dampens energy prices. Lower transportation costs and the sale of stock from very high inventory levels will dampen inflation. With fewer disruptions in production chains, inflation will decrease further preventing a sharp wage-price spiral. As a result, central banks will tighten monetary policy less than anticipated. This scenario would lead to a significant recovery in equity markets.

In a pessimistic scenario, the economy could enter a situation of stagflation with further increases in energy and food prices due to prolongation of the Ukraine war and falling consumer spending, lowering discretionary income and savings. Increases in transportation, energy and labour costs continue to weigh on profit margins, and combined with rising interest, further reduce valuation ratios.

Concluding, markets do not anticipate prolonged high inflation. With the current tight labour market, wage increases are plausible. A healthy labour market with temporarily high inflation levels and slightly negative or low real growth can result in high nominal growth. That would be positive for sales growth. It is uncertain whether companies will be able to maintain profit margins in such a situation, but we have good expectations for companies in our portfolio.

Fixed income

With relatively low interest rate sensitivity, our bond portfolio is able to withstand an interest rate rise with limited losses. The combination of higher interest rates and increased spreads results in a significantly higher yield on corporate bonds.

Equities

Laaken has a relatively high allocation to listed private market managers such as KKR and Partners Group. After very high returns in 2021, this group of equities declined the most in 2022. The rise in interest rates could reduce demand for their private markets funds, increase the cost of debt needed for M&A transactions and depress valuations of companies in their portfolios. We maintain these positions because they manage diversified portfolios that not only include private equity investments, but also real estate, variable loans and infrastructure. In addition, a large share of assets under management (90% in the case of KKR) have a lock-up period of at least eight years, which means that capital cannot immediately flow out when demand falls. Higher interest rates, inflation and financing costs have an impact on valuations of companies, however much more for listed than for non-listed companies. Furthermore, lower valuations also offer opportunities to invest the large sums of uninvested capital. We find the current valuations of KKR and Partners Group acceptable, at ~20x and ~25x the price to profit from fee earnings and expect these companies to deliver excellent returns.

We keep a neutral equity allocation with an emphasis on quality companies with pricing power. Should the global economy face a severe downturn, the Laaken portfolios will also be impacted significantly. With the healthy balance sheets of companies in our portfolio, we believe that these investments have enough resilience to weather the storm and deliver good returns in the long term. We maintain our slightly higher position in gold.