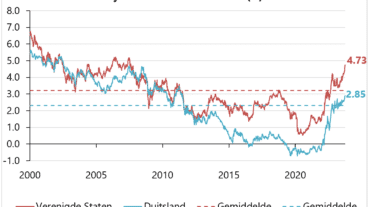

The latest figures confirm that although inflation is declining from high levels, it is not back to the 2% targeted by central banks. In the US and EU, core inflation (excluding food and energy) was 3.8% and 3.1% respectively. Since 2021, the investment committee has taken into account the scenario that global inflation remains at a higher level than that of 2009 to 2021, or a “higher-for-longer” scenario.

What drives inflation? Previous investment outlooks discussed driving factors for inflation such as tight labor markets, housing shortages, geopolitical unrest disrupting global trade, and “pent-up demand” following the end of Covid restrictions.

An important factor for demand-driven inflation is the development of government expenditure. We see the recent trend towards higher government spending continuing. President Biden has suspended the “debt ceiling” legislation in the US until early 2025 after raising the limit. Even in Germany, the willingness to abandon a balanced budget has increased. The necessary expenditure for the energy transition, the recently much discussed “rearmament” of many NATO countries and the election programs of recently elected parties are no indication of declining government expenditure.

Governments also appear willing to raise more debt to finance these expenditures. The US had 60% of GDP in outstanding debt in 1990, which rose to 90% after the 2009 financial crisis. It then moved towards 100% until the brakes really came off during the Covid pandemic in 2020. The debt ratio rose to 132% of GDP. Economists expected this to fall back to the previous level. Three years later, however, the current debt ratio is stable at 120% of GDP. There is slightly more fiscal discipline in the EU, but nevertheless the debt ratio stands at 90% of GDP compared to 84% in 2019 and a Maastricht Treaty standard of 60%.

Debt ratios cannot continue to rise. A lot of research has been done into a solution, but not with clear conclusions. A frequently mentioned solution is persistently higher inflation. Inflation increases nominal GDP growth, while government debt pays a fixed interest rate. For example, if annual inflation reaches four percent, the debt ratio improves. In other words, a million debt after twenty years of inflation of 4% is effectively 450 thousand. Debtors therefore benefit from inflation.

What is the implication for investors? Higher inflation has a downside for creditors (and savers/investors). The purchasing power of every euro declines at the rate of inflation. Investors receive interest as compensation. At the time of writing this outlook, the German government pays approximately 2.5% for a 20-year loan. If interest rates do not change and inflation remains at 3.1%, an investor will lose 0.6% per year. In twenty years’ time, of the one million investment of the previous example, there will be less than nine hundred thousand of purchasing power left.

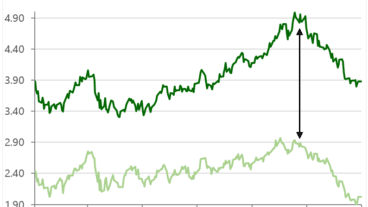

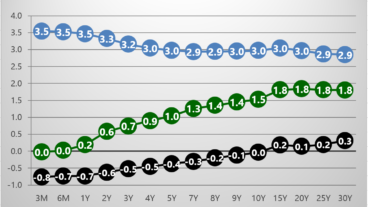

How does Laaken deal with this? Within bonds, Laaken actively looks for higher-yielding corporate bonds and consciously allocates to shorter maturities with higher interest rates in the portfolios.

For equities, inflation is assumed to be negative. Laaken has a more nuanced view. Companies that provide goods or services in a highly competitive market or which are price takers generally suffer from inflation. Costs such as labor and purchasing rise, while prices can hardly be adjusted. A compass that guides our strategy is pricing power. Let us look for example at a company with a turnover of 100 versus costs of 50. If inflation is 10% and if the company can pass on this inflation, turnover increases to 110 and costs to 55. In this scenario, this company achieves 10% profit growth, purely through inflation. Companies typically cannot adjust their prices on a daily basis, but this illustrates why we invest in companies with pricing power and why this strategy can benefit from inflation over the long term.

Fixed income

We remain cautious with interest rate risk given the low interest rates on longer maturities and the inverted yield curve. Recent purchases are characterized by higher duration to maintain the average duration. We prefer corporate loans over government bonds because of the attractive premium.

Equities

We have slightly reduced the equity weighting, but remain invested in equities approximately neutral weighted. The Microsoft position has been reduced because of the significantly higher valuation. We sold the position in WarnerBros. Although operating costs did drop significantly, it is not enough to compensate for the decline in cable TV revenue. We also sold UBS. In our view, the current valuation already reflects a successful integration of Credit Suisse. We also sold Nestlé. They no longer achieve volume growth and will invest more in marketing. With these transactions, allocation to Swiss Franc has also been deliberately reduced. Our position in Avantor was sold after the valuation increased significantly. We increased our positions in Booking Holding Inc., Ares Capital Corporation, Rightmove and Visa. Finally, we sold our position in Brookfield Corporation and built up a new position in a previous Laaken holding: EQT AB. The position in gold has been maintained at underweight.