April 12, 2023

"If the bank runs out of money, the banker may issue as much more as needed by writing on any ordinary paper"

- MONOPOLY rules - Property Trading Game from Parker Brothers (currently Hasbro)World economy

At the beginning of this year, we indicated that macro economists and investor positioning were taking into account a very negative scenario. Average economic growth expectations for 2023 have since been revised upwards and employment has remained high. However, in anticipation/hope of declining policy rates later in the year, current bond yields already started falling and both bonds and equities achieved positive returns. In this investment outlook, we discuss monetary policy, the banking crisis and some macroeconomic statistics.

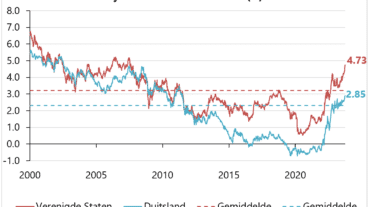

The downside of the improved economic outlook in today’s markets is that central banks still need to fight high inflation. As long as economic demand remains high and the labour market tight, inflation might stay elevated and central banks will continue their monetary tightening. The Fed‘s monetary policy mandate is price stability and maximum employment. The ECB’s mandate is solely price stability. Neither central bank has achieved the goal of price stability yet. Rate rises typically affect the economy with a ~1-year lag, so only now we are seeing the effects of the early 2022 rate increases.

The recent banking panic has caused interest rate expectations to drop significantly, assuming that central banks will have to tighten more cautiously or possibly even revert to monetary easing. The market is now assuming a first interest rate cut by the ECB in circa 6 months. We believe this correction is exaggerated and foresee further rising interest rates amid persistently high core inflation. High inflation in 2022 was largely due to rising energy and food costs. This year, energy and food costs are expected to be deflationary, and inflation will come from rising costs of services, partly thanks to strong wage increases; a more sticky form of inflation that is also more difficult to control.

In our view, the fall of Credit Suisse and the Silicon Valley Bank are mainly company-specific, and not a reason for a major confidence crisis in the banking system, as was the case during the financial crisis in 2007. We also do not expect these events to lead to much greater systemic risks. It does show the vulnerability of the banking system to confidence crises and increases volatility in the markets, but banks are now better off than they were during the financial crisis with higher capital ratios and stronger balance sheets. However, the debt ratios we see with banks would still be considered dangerously high in any other industry.

Macroeconomic indicators currently do not provide a clear picture. Some positive developments: First, US financial institutions currently have 11.4% more Commercial and Industrial Loans and Leases outstanding than a year ago. In Europe, comparable “Loans to Non-Financial Corporations” increased 5.5%. This indicates an increase in investments. Second, the most recent Purchasing Manager Index metric is improving and points to economic growth in both Europe and the US. Third, US consumers, a key driver of economic growth, are still spending more in nominal terms than a year ago and consumer sentiment in the US is improving. Finally, the reopening of the Chinese economy is expected to contribute to more economic growth, especially if it mirrors the path of western economies, which experienced strong increase in post-lockdown demand last year.

Less favourable developments are, for example, the inventory levels in the US. The phasing out of this can slow down economic growth. In addition, the value of (commercial) real estate continues to decline because of interest rate rises and vacancies. Furthermore, average household incomes have risen less than inflation, eroding real purchasing power. Finally, higher interest rates in Europe are leading to more tensions between northern and southern states.

Fixed income

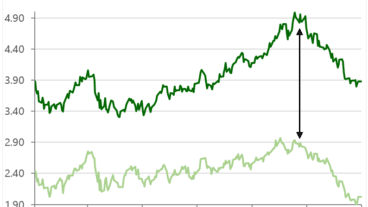

After a sharp rise in interest rates in 2022, the allocation to bonds and the average maturity of the bond portfolio has been slightly increased in the first quarter of 2023. However, the portfolio maintains a lower duration compared to the market average and is therefore relatively well positioned for further interest rate hikes. For the first time in years, we see acceptable returns on government bonds, which we recently added to the portfolios.

The relatively high allocation in bonds from financial institutions (banks and insurers) led to price falls in response to the bank turmoil, but is maintained as we consider the underlying financial institutions to be solid debtors with attractive returns.

Equities

The allocation to equities was lowered to slightly underweight in the first quarter, after reducing some equity positions such as Partners Group and Microsoft because of increased valuations. Equities should offer better protection than bonds against high inflation levels, as we expect that the companies in the portfolio should be able to drive price increases and protect their margins. The focus on profitable companies also pays off in volatile markets, with more than half of the companies in the portfolio currently buying back shares at attractive valuations. High valuations are more sensitive to interest rate rises and during the past year the average valuation of the portfolio has been actively lowered.

The gold position was reduced to the neutral level of 5% as higher interest rates increase the opportunity cost of holding gold.