Once again, the markets in 2024 demonstrated how difficult it is to make accurate predictions. While analysts at the end of 2023 anticipated negative returns, the MSCI World Index in euros ultimately rose by 26% in 2024.

Looking back and learning from the numbers

After two strong years for equities, investors are cautious for 2025—particularly retail investors in the U.S. The AAII sentiment index shows that only 35% expect positive returns in the next six months.

Laaken focuses on the long term. In 2023, Bank of America showed that since 1930, the U.S. stock market has achieved a cumulative return of 22,000%. However, if an investor missed the best 10 days each decade, the total return would be reduced to 57%. This doesn’t negate the fact that fluctuations in corporate earnings or market sentiment can lead to declines. Instead of exiting the market, we at Laaken continually seek opportunities across a broad universe of stocks and bonds.

Longer term: valuation and fluctuations

In 2024, we reduced allocation in more expensive stocks on a structural basis. Our equity portfolio is trading at an average expected price/earnings (P/E) ratio of 21x, in line with the historical average of the Laaken portfolio. The MSCI World Index is trading at an expected P/E ratio of 18x, which is 13% above the index’s historical average. This is mainly driven by large tech stocks, which have high valuations and a heavy weighting in the index. Our portfolio’s higher valuation stems from a focus on high-quality companies with strong growth prospects. While a market correction would naturally affect our portfolios as well, in the long run we anticipate that this quality and valuation focus will lead to a stronger recovery if such a scenario materializes.

Trumponomics 2.0: opportunities and risks

A 2025 outlook cannot ignore Donald Trump. With his re-election as the 47th president of the U.S., he is once again focused on deregulation. Under President Biden, 851 new laws were passed, at a total estimated cost of around USD 1.4 trillion. Although regulations stem from good intentions, they lead to higher costs. Scaling back these regulations can benefit corporate profits.

Deregulation also creates opportunities in the mergers and acquisitions market. Under Biden, U.S. regulatory bodies such as the FTC and DOJ took a stricter approach to M&A. Furthermore, the IPO market has been weak since 2022, partly due to changing regulations and higher compliance costs. Trump has indicated plans to reverse these trends. Our equity portfolio is well positioned for such developments, with significant exposure to financial institutions such as KKR and Apollo Global Management.

Nonetheless, Trump also introduces risks and volatility. He advocates for increased domestic production and higher import tariffs, which could affect global trade. The American consumer accounts for 18% of worldwide economic activity, and any disruption could have global ramifications.

Europe: treading water in regulations and high energy costs

Whereas the U.S. is characterized by innovation and deregulation, Europe is more the opposite. Consumer protection is stronger in Europe than in the U.S. In fields such as AI, businesses report that the political climate and data protection requirements hinder innovation. Europe also continues to suffer from relatively high energy prices due to Russia’s invasion of Ukraine.

Sectors: optimism with a couple of exceptions

Within our equity selection, companies—except in two sectors—are optimistic about the future. The exceptions are Healthcare and Real Estate. The Healthcare sector is dealing with high inventories built up during the Covid period. Real Estate is grappling with high interest rates, which slow down home sales. Our exposure to this sector is for example limited to Rightmove and Lowe’s. Rightmove relies on a subscription model and is thus less dependent on transaction volumes, while Lowe’s benefits more from renovations and maintenance than purely from home sales.

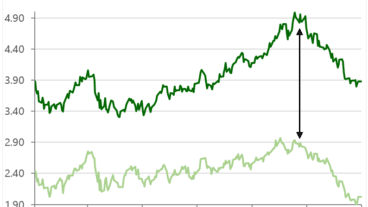

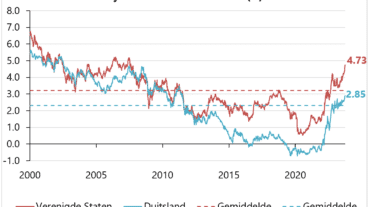

Inflation and interest rate cuts: a paradox for 2025

In both the U.S. and Europe, core inflation hovers around 3%, above the 2% target. Yet central banks are considering lowering interest rates. In the U.S., there is a chance of higher government spending and lower corporate taxes, which could fuel inflation further. If an interest rate cut fails to materialize, valuations for equities could come under pressure. That investors are on guard is evident from the SKEW index, which indicates that many are already hedging against a potential correction. At the same time, a lower tax burden could lead to increased investment and faster GDP growth.

Conclusion and positioning

All in all, as we enter 2025, we see sufficient reasons to maintain our neutral stance in our selection of equities and bonds, while remaining vigilant about valuations that are too high and macroeconomic risks.

- Bonds and liquidities: We do not find the premium on long-term European bonds attractive and continue to favour corporate bonds over government bonds. Additionally, we recently increased our allocation to USD-denominated loans.

- Equities: We have exchanged more expensive positions for comparatively lower-valued stocks. Our allocation to technology companies has been raised. We continue to maintain our overweight position in U.S. companies.

- Precious metals: We are keeping our gold holdings as insurance against political and economic uncertainty.

By maintaining our focus on quality and a broadly diversified portfolio, with this we expect to lay a stable foundation for our portfolios in 2025.