January 9, 2024

"As long as the roots are not severed, all is well. And all will be well in the garden."

- Chance the gardener, played by Peter Sellers in the movie Being There from 1979World economy

After a weak 2022 in which stocks and bonds fell, markets rebounded strongly in 2023. The MSCI World stock index closed the year with an increase of 18.9%. The Bloomberg Barclays Euro Aggregate bond index rose 7.2%. The Laaken security selection generated additional returns.

Around this time of year, asset managers and banks write forecasts for the next twelve months. At the beginning of 2023, almost all banks were convinced of a declining economy. This resulted in predictions for negative stock market returns. We also painted a cautious picture at the time, but with the caveat that stock markets look ahead several quarters and that sentiment according to the AAII index was already very low. Economies and financial markets surprised positively in 2023.

At the beginning of 2024, bank expectations have turned considerably. The majority expects that central banks will succeed in slowing down the economy without causing a recession, a “soft landing”. Banks do see the higher interest rates as a continued major risk. Many recession predictions have still been pushed further out caused by a better-than-expected 2023. Is this the right time to “get out of the stock market”?

In response, we look at investor expectations and positioning. But how do we determine this? Bank outlooks are a data point. Another data point is the aforementioned AAII index. This shows that 51% of American private investors think the stock market will be higher in six months. Laaken has access to allocation data from 250 asset managers with a total of $690 billion under management. They now hold average cash levels of 4.5%, in line with the 24-year average. Managers hold more cash when they see risks. The average cash level was 4% at the end of ’21 and almost 6% at the end of ’22. We think that private individuals are relatively positive, but that professional investors are still moderate.

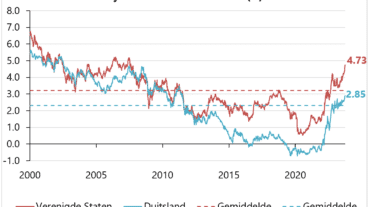

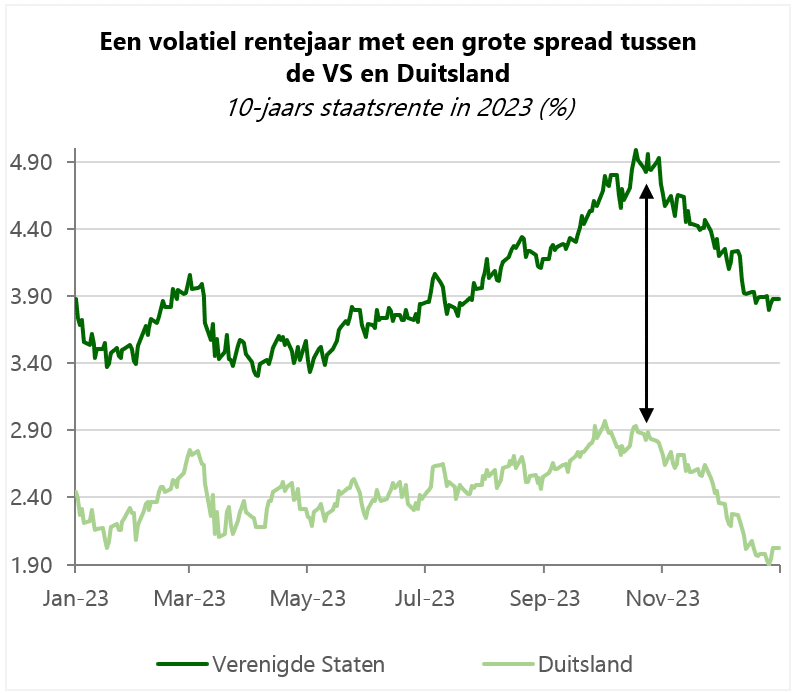

In addition to expectations and positioning, interest rate policy is of great importance. The 10-year yield in both the US and the Eurozone rose in the first 9 months of 2023, but fell sharply in the last 3 months. On balance, interest rates in the US remained the same at 3.9% and German interest rates fell from 2.5% to 2.0%. The US central bank (Fed) indicates that, depending on inflation figures, it will probably reduce the policy interest rate in 2024. American and European interest rates reacted strongly to this. The futures markets now price in a sharp drop in the policy interest rate of ~1.5% in 2024. We are more cautious and expect that such a drop in interest rates may take longer, especially in Europe, due to the following points:

First, the labor market remains tight with historically low unemployment rates in both the US (3.7%) and the Eurozone (6.5%). This leads to upward pressure on wages, higher wage-price spiral risks and possibly longer-lasting inflation (“higher for longer”). If inflation figures are disappointing, central banks will find it more difficult to implement interest rate cuts. Secondly, in our view the ECB is lagging behind the Fed. Since 1994, the 2-year interest rate in the Eurozone and the US has been converging over time, but since the faster and larger interest rate increase in the US, this difference is now almost 2%. Finally, ECB President Lagarde recently reported, in contrast to the Fed, that she “has not yet discussed any interest rate cuts”. Falling interest rates in the US do not necessarily have to lead to the same decline in the euro zone.

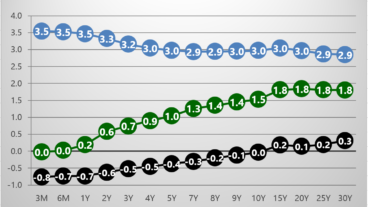

Fixed income

We remain cautious taking interest rate risk. Long-term interest rates in the Eurozone are low compared to expected inflation. The real return (after inflation) is attractive in the US, but not for European investors due to currency risk. The additional return on corporate bonds is relatively high, and we therefore prefer high quality corporate bonds to government bonds. Corporate bonds with slightly longer maturities (5-10 years) can also be interesting. We always evaluate risk/return critically. This ratio has improved since 2021 due to the strong interest rate increase in 2022 and decreasing inflation in 2023.

Equities

We maintain a neutral weighting for equities. Although equity index valuations are higher than a year ago, we still see attractive opportunities in the market. The S&P 500 is heavily driven by Nvidia and six other technology companies. Without the well-discussed “magnificent seven” appreciation would have been a lot less. The differing valuations have been used to reduce higher valued holdings and build up positions in attractively valued companies. For example, we recently purchased Lowe’s, Rentokil and Rightmove. The last company is this quarter’s thesis. Furthermore, it is a good example of active investing as Laaken sees it. We monitor all our holdings and keep track of developments in our database. Rightmove’s shares fell because a large company acquired a small competitor of theirs. In such a case, we evaluate the risks and after contacting the CFO, we decided to take advantage of this decline to significantly expand the position.

Our relatively high exposure to private equity companies such as KKR has strongly contributed to the return of the Laaken portfolios this year. A lot of media attention was focused on these companies’ problems raising capital, but this was not the case with KKR. We spoke to the company in December 2023 in New York. They show growth in assets under management. Pension funds choose well-established names such as KKR because they have a long track record. Furthermore, KKR has a large team that targets operational improvements at portfolio companies. We expect capital flows to private markets to continue. A share in these companies gives us exposure to management fees and performance fees, without being tied up for >10 years, which is the case for investors in this private equity. Liquidity remains a very important criteria of Laaken.

The position in gold was reduced to underweight in the fourth quarter of 2023.