World economy

In a world where any scheduled meeting two weeks out could be cancelled, writing an outlook is a challenge. We attempt to address the most relevant themes for the new year below:

Firstly, Omicron shattered the hope of leaving the grasps of Covid in 2021. Despite more than 60% of the US and European population receiving two or more vaccine shots, many countries locked down again. Financial markets saw limited impacts compared to March 2020. Firms adjusted to circumstances, government subsidies have largely remained in place and the current lock down is less drastic than the previous. Consensus expects continued and above trend growth in 2022 from a continued recovery over 2020. Omicron is more transmissible than previous variants, but evidence from the African Health Research Institute suggests it is less deadly and also generates resistance to the Delta variant. Global measures, to contain the increasing amount of infections, and the possibility of new variants might force us to adjust growth expectations.

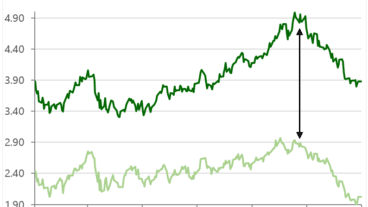

Secondly, the current inflation levels. Inflation reached 6.8% and 4.9% respectively in the US and Europe, the highest levels in 39 and 30 years. Covid-19 caused supply chain disruptions, which increased transportation and food costs as well as capital goods such as cars. These disruptions might be transitory in nature. We also see enduring factors in inflation such as energy costs. The transition to renewable energy includes closing polluting, but inexpensive energy sources. Higher inflation can lead to structurally higher wages, which in turn results in structurally higher inflation.

The FED initially spoke of transitory inflation; temporary high inflation. It recently distanced itself from this term. However, financial markets expect limited inflation. This can for example be seen from the negative interest rates on the Netherlands and Germany 10-year bonds. Bondholders should be compensated for the expected devaluation. At current inflation levels and interest rates however, bondholders see more than 5% loss of purchasing power.

Finally, uncertainties in the geopolitical outlook remain. Russia stationed hundred thousand soldiers at the border with Ukraine, increasing the risk of an invasion. It reminds many of 2014, when Russia annexed Crimea. In the Middle East, US and Iran attempt to salvage the nuclear deal. Trump announced in 2018 that the US would formally withdraw from the nuclear accord as it began imposing sanctions on Iran. The Biden administration held six indirect rounds with Iran mediated by the EU. There was still no agreement at the end of December 2021. In Asia, we see palpable tensions between Taiwan and China. The ruling party in Taiwan, the DPP, tries to balance pleasing the locals with talks of independence and keeping China content. Taiwanese regulators recently determined that chip-related firms must obtain state approval before selling segments and/or factories to Chinese owned enterprises. Meanwhile, China is still behind the “One-China policy”. We do not invest in firms in Russia, China, Taiwan or the Middle East, but have indirect exposures through for example ASML and LVMH.

Given our view on the financial markets and macro economy, we positioned our portfolio as follows:

Fixed income

We remain underweight bonds given negative real returns. We continue to find variable or short duration bonds of solid issuers with low, yet positive expected returns. If the interest rates pick up, the coupon of variable bonds increases, while the shorter duration bonds grants us the option to redeploy capital in higher yielding bonds at expiration.

Equities

We remain slightly overweight equities. We critically assess the relatively expensive equities and continually seek firms with pricing power and high growth to offset a potential multiple contraction over time. Examples include LVMH, Microsoft and S&P Global. Such firms feature relatively attractive valuations, but are also not characterised by low multiples. Hence, the Laaken portfolios trades at relatively higher price/earnings ratios, but feature high profitability, good returns on invested capital and can likely generate substantial earnings growth over a four to five year period.

Central banks pursuing less expansionary monetary policy could pressure valuation across equities. However, we expect significant recovery potential in the current Laaken portfolios if rates rise. Interest rate expectations increased in December 2021 after the FED meeting. The news hit firms with no earnings and high valuations especially hard. On the other hand, our equity portfolio remained robust. We maintain our gold position as an inflation hedge and insurance against geopolitical uncertainty.