April 10, 2025

"We're entering the most disruptive phase of trade since the Great Depression. Or not. We just don’t know."

- Richard E. Baldwin, professor of international economics at IMD Lausanne, March’25After two remarkably strong years for global equities, 2025 opened with a shift in tone. In Q1, the MSCI All-Country World Index fell by 6% in euro terms. Heightened geopolitical instability, rapid technological disruption, and diverging central bank actions added layers of uncertainty. This outlook outlines the major trends shaping markets and how Laaken is responding.

AI Disruption: A Surprise from China

Until recently, the U.S. was considered the undisputed leader in AI. That changed when Chinese firm Deepseek introduced a chatbot rivalling American models like ChatGPT. Remarkably, Deepseek achieved this performance using two-generation-old Nvidia chips, constrained by export restrictions.

This development raises a pressing question: Is it necessary to spend billions on the latest, most expensive Nvidia hardware? Global tech companies are projected to invest over $300 billion in AI infrastructure in 2025, but spending efficiency is now under scrutiny.

For Laaken, this triggered a reassessment of our modest Nvidia position. Two pre-identified risks—its overreliance on Big Tech clients (50% of revenue) and the potential for technological disruption—have become more pressing. We chose to exit our Nvidia stake.

Geopolitical Volatility: Trump’s Return and Market Impacts

If there’s one constant in early 2025, it’s the policy uncertainty driven by President Trump. U.S. equity markets have sold off sharply, while European and Asian equities have risen.

Trump’s policy approach remains erratic. Within weeks of taking office, he introduced import tariffs on goods from the EU, China, Mexico, and Canada—some of which were revoked within 24 hours. He later targeted products like champagne, automobiles, and electronics in new threats.

Domestically, Trump appointed Elon Musk to lead the new “Department of Government Efficiency” (DOGE), tasked with slashing $1 trillion in federal spending. USAID has been dismantled, and federal employees must now provide weekly accountability reports or face automatic termination.

The “rule of law” appears under pressure: certain media outlets have been banned from the White House, and Trump opponents face new legal probes.

Comments about annexing Greenland and Canada and a live exchange with President Zelensky of Ukraine—where Trump made inflammatory remarks—sparked backlash from European leaders. In response, many European nations reaffirmed support for Ukraine and accelerated defence budget increases.

For markets, this translates into heightened uncertainty. Given the unpredictability of Trump’s actions, we focus instead on behavioural patterns: he often backtracks after harsh threats and prefers not to see markets in prolonged decline.

Europe Moves Closer Together – Germany Steps Up

As the U.S. turns inward, Europe is experiencing a renewed push for unity. Support for anti-EU parties is fading, and new efforts are underway to strengthen political and economic cooperation.

Germany has pivoted decisively. In early 2025, the country unveiled an ambitious infrastructure investment plan, a marked departure from its traditional emphasis on fiscal discipline. We explore the investment implications of this shift in the “Individual Positions” section.

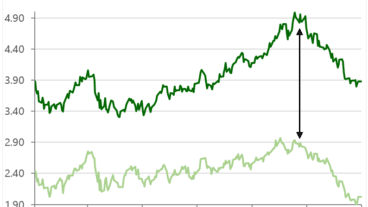

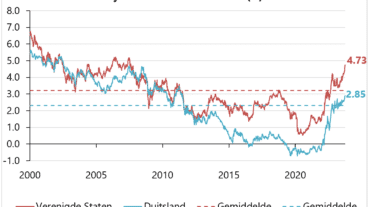

Diverging Central Bank Paths

The European Central Bank (ECB) and the U.S. Federal Reserve are now heading in opposite directions. The ECB is signalling potential rate cuts later this year, while the Fed has paused.

Both economies face core inflation around 3%, but underlying conditions differ. In Europe, German fiscal stimulus may push long-term rates higher. In the U.S., rising costs and weakening consumer confidence—partly due to public-sector job cuts—pose challenges.

Despite these risks, the U.S. economic outlook remains broadly positive. Many institutional investors have already reduced their exposure to U.S. equities, partially pricing in potential volatility.

Portfolio Positioning

Fixed Income: Our bond portfolios maintain a relatively short duration. This limited the impact of rising rates. We remain attentive to further rate shifts, especially in Europe.

Equities: We are modestly underweight equities, driven largely by U.S. political instability. Nonetheless, we remain confident in our stock selection, which has recently delivered strong results. Our focus is on companies with solid fundamentals and predictable cash flows.

Precious Metals: We maintain our gold position, given its role as a geopolitical hedge. However, we have chosen not to increase this allocation due to already elevated gold prices.