Proven wealth management

For private individuals, families, entrepreneurs and foundations - from € 250.000

Laaken brings wealth management back to its essence: constructing optimal investment portfolios in order to achieve better returns than the market. If you would like to know how to benefit from our proven investment strategy, please contact us.

Which service suits you?

Wealth management

From € 1.000.000- Personal advice

- Custom portfolio

- Periodic (advice) review

- Annual costs = 0,37% - 1,36%

- Daily liquidity

- Custody bank of your choice

Investment funds

From € 250.000- Client selects which fund

- Model portfolio

- Contact on your initiative

- Annual costs = 1,09%

- Monthly liquidity

- Invest via registration

About Laaken

A professional wealth manager must actively strive for better returns than the market. The vast majority of wealth managers are unable to do this and are therefore increasingly opting for passive investments. They increasingly follow the market; but do not recoup the management fees. Do you get the most out of your portfolio this way? We are convinced there is a better way.

Excellent returns since 2007

At Laaken we achieve a significantly better return than the market since 2007. This result makes Laaken one of the best performing wealth managers in the Netherlands.

The Defensive risk profile invests ~35% in equities and ~65% in fixed income. This model portfolio forms the basis of both the Laaken Defensive Fund and the private accounts with a defensive strategy. Actual investment results may (slightly) deviate from the model portfolios.

The cumulative gross return (before costs) of this model portfolio since inception in 2007 was 178.8%. During the same period, the market made a cumulative return of 116.7%. This means that Laaken has achieved an outperformance of 62.1%. The average gross return per year was 5.8% versus the benchmark of 4.4%.

The Balanced risk profile invests ~60% in equities and ~40% in fixed income. This model portfolio forms the basis of both the Laaken Balanced Fund and the private accounts with a balanced strategy. Actual investment results may (slightly) deviate from the model portfolios.

The cumulative gross return (before costs) of this model portfolio since inception in 2007 was 323.2%. During the same period, the market made a cumulative return of 189.4%. This means that Laaken has achieved an outperformance of 133.9%. The average gross return per year was 8.3% versus the benchmark of 6.1%.

The Offensive risk profile invests ~90% in equities and ~10% in fixed income. This model portfolio forms the basis of both the Laaken Offensive Fund and the private accounts with an offensive strategy. Actual investment results may (slightly) deviate from the model portfolios.

The cumulative gross return (before costs) of this model portfolio since inception in 2007 was 443.7%. During the same period, the market made a cumulative return of 301.9%. This means that Laaken has achieved an outperformance of 141.8%. The average gross return per year was 9.8% versus the benchmark of 8.0%.

The Equity risk profile invests ~100% in equities. This model portfolio forms the basis of the private accounts with an equity strategy. Actual investment results may (slightly) deviate from the model portfolios.

The cumulative gross return (before costs) of this model portfolio since inception in 2007 was 568.3%. During the same period, the market made a cumulative return of 374.3%. This means that Laaken has achieved an outperformance of 194.0%. The average gross return per year was 11.1% versus the benchmark of 9.0%.

Risks

Investing involves risks such as markt risk, price risk, credit risk, interest rate risk and currency risk. You may lose the entire principal. The value of your investment depends on developments in the financial markets. Past performance is no guarantee for future results.

Independent comparison platforms award Laaken a 5-star review

Independent comparison platforms award Laaken a 5-star review

Why invest at Laaken?

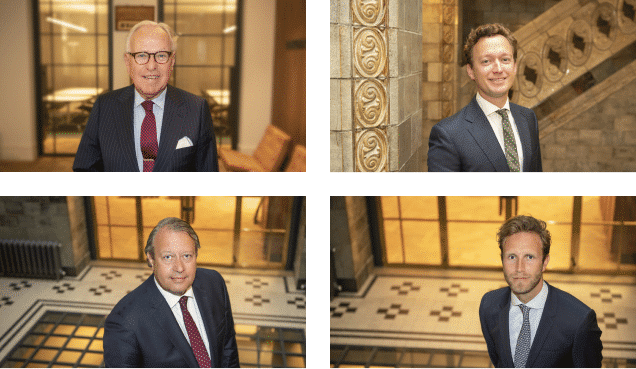

Laaken has one of the best track records among Dutch managers since inception in 2007. The active deviation from the market by our team of experienced investors has led to very strong results.

The partners invest the same as our clients. Furthermore, Laaken is not a bank. As an independent manager, we do not benefit from transactions and financial products in the portfolios. Wealth management is our sole activity, our only focus is achieving your investment goals.

Our portfolios consist of highly liquid securities that can be sold any time. We do not commit to investments that lock up for a longer period of time.

We would like to get in touch

Are you interested in our services? Feel free to contact us or request our brochure for more information

Investment Outlook & Thesis

Investment outlook first quarter 2025

After two strong years for equities, investors are cautious for 2025—particularly retail investors in the U.S. The AAII sentiment index shows that only 35% expect positive returns in the next six months. Instead of exiting the market, we at Laaken continually seek opportunities across a broad universe of stocks and bonds.

Read the full outlook

Alimentation Couche-Tard

Alimentation Couche-Tard (ATD) is the world's second-largest operator of convenience stores, with nearly 17,000 locations worldwide, including all TotalEnergies outlets in the Netherlands. Although selling fuel, drinks, and snacks may not sound as exciting as AI, convenience store chains are among the biggest success stories in the stock market.

Read the full thesisWe would like to get in touch

Are you interested in our services? Feel free to contact us or request our brochure for more information